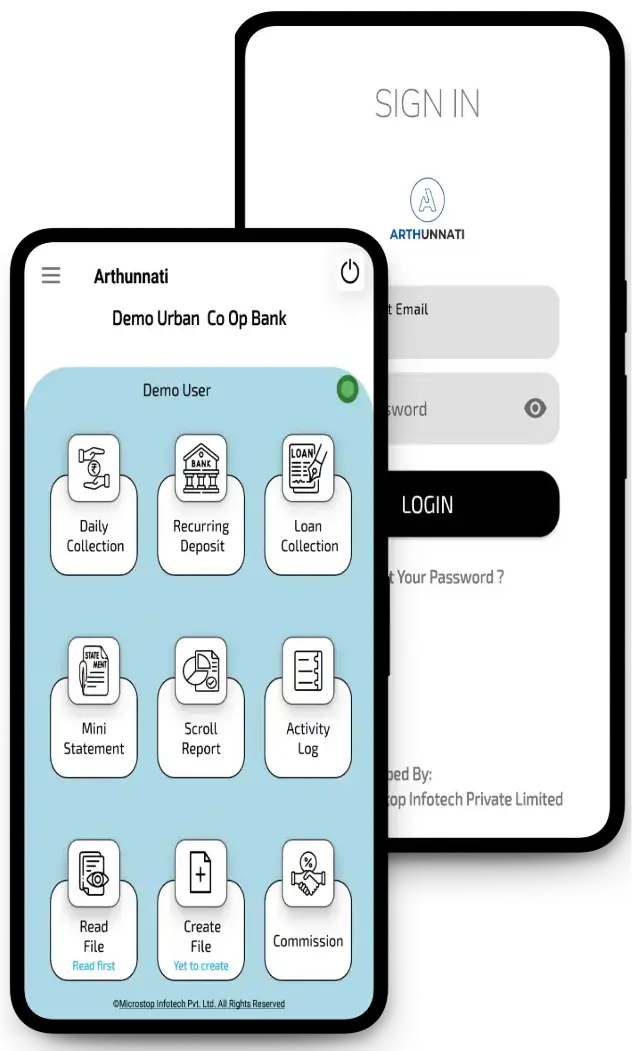

अर्थउन्नती सॉफ्टवेअर: सर्वसमावेशक आर्थिक व्यवस्थापन

आमचे सॉफ्टवेअर विविध विभागांसाठी सुलभ वित्तीय व्यवस्थापन प्रदान करते. सभासद, बचत, ठेवी, आणि अल्प बचत यांसारख्या कार्यांमध्ये मदतीसाठी एकत्रित सुविधा. शेअर्स, कर्ज, व्याज आकारणी आणि एजंट कमिशन यांसारख्या सर्व व्यवस्थापनास सोपं बनवण्यासाठी सर्व डेटा मराठीत मिळवता येतो.

सभासद विभाग

आमच्या सॉफ्टवेअरमध्ये सभासदांची यादी तयार करण्याची सुविधा आहे, जी विविध निकषांनुसार (नाव, भागक्रमांक, डायरेक्टर शिफारशी) केली जाऊ शकते. शेअर सर्टिफिकेट्स, कर्ज-लिंकींग शेअर्स, शेअर्स ट्रान्सफर, आणि लाभांश आकारणी सहजपणे केली जाऊ शकते. लाभांश कर्ज खात्यात आपोआप वर्ग करणे, तसेच सभासदांचे फोटो, सहीचा नमूना, नाव व पत्ता यांचे लेबल तयार करणे शक्य आहे. सगळं कार्य मराठीत केले जाऊ शकते.

बचत व चालू खाते विभाग

या विभागात खातेदारांची माहिती, दैनंदिन व्यवहारांची नोंद ठेवता येते. खात्यावरील किमान शिल्लक आणि स्टँडिंग इन्स्ट्रक्शन्सची सुविधा, चेक बुक सुविधा, आणि बचत खात्यावर सहामाही व्याज मिळवता येते. खाते आकारणी, सही व फोटोची सुविधा उपलब्ध आहे, तसेच खात्याचा उतारा देखील सहज मिळवता येतो.